« December 2005 | Main | March 2006 »

February 23, 2006

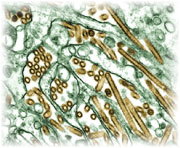

Society of Actuaries embarks on unique research around pandemic influenza and the U.S. insurance industry’s preparedness

The Society of Actuaries (SOA) is beginning research on the possible implications of an avian flu pandemic on the insurance industry. With this study, the SOA expects to provide insight into the potential impact a pandemic could have on life and health insurers.

The Society of Actuaries (SOA) is beginning research on the possible implications of an avian flu pandemic on the insurance industry. With this study, the SOA expects to provide insight into the potential impact a pandemic could have on life and health insurers.

Jim Toole, fellow of the Society of Actuaries and managing director of MBA Actuaries, will undertake the effort. Toole brings his actuarial expertise in risk measurement and management to address the readiness of the insurance industry to face a pandemic.

“Advance planning is critical. An insurer needs to do more than just study how a pandemic might affect the amount and timing of claim dollars it pays to its policyholders. It will also need to consider how it will function at unprecedented claim volumes, when as many as 50 percent of its employees are ill or absent providing care for family members. The research will assess the total risk to an insurer, discussing vital considerations for before, during and after an event that might mitigate or exacerbate the consequences of a severe or moderate pandemic,” said Toole.

Tom Edwalds, fellow of the Society of Actuaries and chairperson of the SOA's oversight committee for this research, believes "the possible effects of pandemic influenza are important to the U.S. life and health insurance industry because it may increase the severity and frequency of the payment of death benefits and medical treatment compared to anticipated, potentially affecting an insurer's or reinsurer's solvency. For actuaries and other risk management professionals examining the risk of pandemic influenza, understanding the potential impact of the event on U.S. mortality and morbidity is critical. We believe this research will be a useful resource for them."

Results from this research initiative will be made available during the SOA's Spring Health Meeting in June in Hollywood, Fla.

Background

Effect of Pandemic Influenza on North American Mortality and Morbidity

Pandemic Influenza naturally occurs every 30-40 years. The last three events were in 1918, 1957, and 1968.

Health experts believe that the current avian influenza (H5N1) now circulating in East Asia is the greatest risk for creating a new pandemic. The World Health Organization has confirmed 57 deaths (as of 8/5/05) in Vietnam, Cambodia, Thailand, and Indonesia. Over ten countries have experienced outbreaks in poultry flocks, which indicates that H5N1 is endemic throughout the region.

The possible effects of pandemic influenza are important to the North American life and health insurance industry because it may increase the severity and frequency of the payment of death benefits and medical treatment compared to anticipated potentially affecting an insurer’s/reinsurer’s solvency. For actuaries and other risk management professionals examining the risk of pandemic influenza, understanding the potential impact of the event on North American mortality and morbidity is critical.

Pandemic influenza also has significant economic consequences for the North American economy. It is important that the actuary understand the potential economic consequences and their implications to an insurance company.

II. PURPOSE

One purpose of this project is to create reference material to educate actuaries and other risk management professionals on North American mortality and morbidity risks of pandemic influenza. In addition, the information provided is to be a resource for the development of mortality and morbidity assumptions regarding the long-tail risk of pandemic influenza for scenario testing.

A second purpose of the research is to provide informaton on the economic consequences of a pandemic influenza event in North America and to analyze the implications for the life insurance industry.

III. RESEARCH OBJECTIVE

The first objective for this project is to perform analysis relating to the effect of pandemic influenza on mortality and morbidity by identifying, reviewing and compiling data and findings from existing literature/studies and/or original research.

The second objective for this project is to examine the economic effect of pandemic influenza in North America. Using the results developed on the effect of pandemic influenza on mortality and morbidity, the researcher will examine the economic costs to society borne by a possible pandemic influenza outbreak. Finally, the researcher will analyze the implications that the economic costs will have on the life insurance industry.

Inputs to be considered in meeting the research objective may include but are not limited to: a literature search of historical information, a survey utilizing the Delphi method of actuaries and/or risk managers, and a search for existing models of pandemic influenza.

Research results will be summarized into a report suitable for publication that consists of but is not limited to the following:

· Ranges of morbidity and mortality rates assuming that pandemic influenza has occurred;

· Reasons for the estimated ranges; and

· Parameter sets which will allow users to run their own Monte-Carlo scenarios.

· Economic cost estimates;

· Methodology and reasons for arriving at that cost; and

· Implictions of the economic costs on the life insurance industry.

For this topic, the Committee on Life Insurance Research envisions a short-term project with an expected timeframe for completion of three to six months. For final evaluation of proposals, it is important that researchers comment on how this timeframe can be reasonably ensured.

IV. PROPOSAL

To facilitate the evaluation of proposals, the following information should be submitted:

1. Resumes of the researcher(s), including any graduate student(s) expected to participate, indicating how their background, education, and experience bear on their qualifications to undertake the research. If more than one researcher is involved, a single individual should be designated as the lead researcher and primary contact. The person submitting the proposal must be authorized to speak on behalf of all the researchers as well as for the firm or institution on whose behalf the proposal is submitted.

2. An outline of the approach to be used, emphasizing issues that require special consideration. Details should be given regarding the techniques to be used, collateral material to be consulted, and possible limitations of the analysis.

3. Cost estimates for the research, including computer time, salaries, report preparation, research costs, etc. Such estimates can be in the form of hourly rates, but in such cases, time estimates should also be included

4. Any guarantees as to total cost should be given and will be considered in the evaluation of the proposal. While cost will be a factor in the evaluation of the proposal, it will not necessarily be the decisive factor.

5. A schedule for completion of the research, identifying key dates or time frames for research completion and report submissions.

6. Ideas regarding the form and distribution of the final report, both for immediate release and for permanent reference (e.g., submission to North American Actuarial Journal or other refereed publication, TSA Reports, SoA Monograph Series, CD ROM).

7. Other related factors that give evidence of a proposer’s capabilities to perform in a superior fashion should be detailed.

V. SELECTION PROCESS

The Committee on Life Insurance Research (CLIR) is responsible for the selection of the proposal to be funded. Input from other knowledgeable individuals also may be sought, but CLIR will make the final decision. The SOA’s Research Actuary will provide staff actuarial support. A Project Oversight Group (POG) will be appointed by CLIR to oversee the project upon selection of the proposal.

VI. QUESTIONS

Any questions regarding this RFP should be directed by fax, or e-mail to: Ronora Stryker, SOA Research Actuary (Fax: 847-273-8514; e-mail: rstryker@soa.org).

VII. NOTIFICATION OF INTENTION TO SUBMIT PROPOSAL

If you intend to submit a proposal, please send written notification by November 22, 2005 to:

Jan Schuh, SOA Research Administrator

e-mail (jschuh@soa.org)

FAX (847-273-8556)

mail to

Society of Actuaries

475 N. Martingale Road, Suite 600

Schaumburg, IL 60173-2226.

VIII. SUBMISSION OF PROPOSAL

Please e-mail a copy of the proposal to:

Jan Schuh at jschuh@soa.org

Proposals must be received no later than November 30, 2005. It is anticipated that all researchers who have submitted proposals will be informed of the status of their proposal no later than January 15, 2006.

Note: Proposals are considered confidential and proprietary.

IX. CONDITIONS

The Society of Actuaries reserves the right to not award a contract for this research. Reasons for not awarding a contract could include, but are not limited to, a lack of acceptable proposals or a finding that insufficient funds are available to proceed. The Society of Actuaries also reserves the right to redirect the project as is deemed advisable.

The Society of Actuaries intends to copyright and publish the results of this research. The research will be considered work-for-hire and all rights thereto belong to the Society of Actuaries. However, appropriate credit will be given to the researcher(s).

Posted by Tom Troceen at 01:08 AM

Aon Consulting Appoints a Chairman and Vice Chairman of U.S. Operations

Aon Consulting, the human capital and management consulting organization of Aon Corporation, announced today that Michael Gulotta and Roger Vaughn have been appointed chairman and vice chairman of Aon Consulting U.S., respectively. These are newly-created positions within the organization, specifically designed with a focus on delivering high-impact client service.

"As chairman of Aon Consulting U.S., Mike is charged with driving innovation and thought leadership by enhancing our client service Model and providing guidance on the development of distinctive client offerings," said Andrew Appel, chief executive officer of Aon Consulting. "Roger will serve as vice chairman of Aon Consulting U.S. In this role, he will focus on better meeting the needs of key clients in large and multinational markets."

Gulotta currently serves as executive relationship manager for a number of Aon Consulting's largest clients. He is a member of the Executive Global Operating Committee, Aon Consulting's executive leadership team. Gulotta joined the organization in 2000, when Actuarial Sciences Associates (ASA) merged with Aon. At that time, he had been ASA's president and chief executive officer for 16 years. Gulotta began his career as an actuary, and has worked with clients worldwide on a range of human resource issues for nearly 30 years.

Vaughn becomes vice chairman, moving from his current position as

president of Aon Consulting U.S. He is also a member of Aon Consulting's Global Operating Committee. Vaughn joined Aon Consulting as an actuary in 1977, and for nearly 30 years, he has assisted clients with programs designed to attract, retain, develop and reward high-quality employees.

"It's a tribute to the strength of our existing talent that we can elevate two of our senior leaders into these new positions," said Appel. "Both Mike and Roger embody all we aspire to in terms of putting our 'best in front' of our clients and developing unmatched talent. Having Mike and Roger in these roles will further enhance our ability to provide high-impact client service through greater innovation and thought leadership."

For more information, contact: Joe Micucci, Aon Consulting, 312-381-4786, joe_micucci @ aon.com

Posted by Tom Troceen at 01:05 AM

February 13, 2006

Actuaries Urge President to Address Medicare's Deteriorating Finances in the State of the Union Address

While tackling high medical costs and reducing the number of uninsured are sure to be highlights of President Bush's State of the Union address, actuaries are urging the president to include Medicare's financial concerns in the discussion.

While tackling high medical costs and reducing the number of uninsured are sure to be highlights of President Bush's State of the Union address, actuaries are urging the president to include Medicare's financial concerns in the discussion.

"Reducing the number of uninsured Americans and making health care more affordable are certainly important and worthwhile goals. However, we urge the president to address Medicare's viability as well," said Cori Uccello, the American Academy of Actuaries' senior health fellow. "Addressing health care costs without tackling Medicare's financial problems would ignore a significant piece of the health care puzzle."

Uccello and the Academy, citing recent Medicare Trustees Reports, have repeatedly warned of the significant long-term financing problems facing the program. Academy issue briefs such as Medicare's Financial Condition: Beyond Actuarial Balance and Medicare: Next Steps stress that the fund for Medicare's Hospital Insurance program, which pays for inpatient hospital care and is financed primarily through earmarked payroll taxes, is expected to be tapped

out by 2020.

"Unless Medicare undergoes fundamental change, the program will face increasing financial pressures and ultimately won't have enough money to pay benefits," Uccello said. "In addition, the rising number of Medicare beneficiaries and increasing health care costs will cause Medicare to consume ever-growing shares of the federal budget and the economy as a whole."

Total Medicare spending was $309 billion in 2004, or 2.6 percent of the nation's Gross Domestic Product (GDP). Medicare spending will likely increase to 3.3 percent of GDP in 2006, and then is expected to double to nearly 7 percent of GDP by 2030, continuing to rise thereafter. If total federal revenues continue at their historical average of about 19 percent of GDP, and if no changes are made to the program, Medicare spending will take up a third of all federal revenues by 2030.

Increased spending for Medicare will place a growing strain on the U.S. economy and may crowd out other federal programs.

"The federal government is responsible for funding national defense, homeland security, Social Security, interest on the national debt, and thousands of other programs," Uccello said. "When Medicare totals a third of the budget, what programs will we be able and willing to eliminate or cut dramatically?"

While it is unknown what tradeoffs the nation will be willing to make in the future, Uccello stressed that without fundamental changes in Medicare financing it is almost certain that hard choices will have to be made.

"The president is appropriately turning attention to high health care costs and the uninsured," Uccello said, "but at the same time Medicare also must be addressed, and sooner rather than later."

For more information or to schedule an interview with Cori Uccello, call Andrew Simonelli, media relations manager, at 202.785.7872. Copies of Medicare's Financial Condition: Beyond Actuarial Balance and Medicare: Next Steps can be accessed by visiting:

http://www.actuary.org/pdf/medicare/financial_march05.pdf

http://www.actuary.org/pdf/medicare/next_feb05.pdf

The Academy is a 15,000-member non-profit, non-partisan professional association representing all actuaries practicing in the United States. Based in Washington, D.C., the Academy conducts an extensive public policy program at the state, federal, and international levels, bringing actuarial expertise to bear on issues such as Social Security, Medicare, insurance regulation, and pension reform. The Academy also sets and maintains standards of actuarial

qualification and practice.

Posted by Tom Troceen at 07:23 PM

Introducing the Fundamentals of Actuarial Practice

The focus of this week’s Present Value is the introduction, starting in January 2006, of the web-based Fundamentals of Actuarial Practice (FAP) course. FAP represents another major milestone in the redesign of the basic Education and Exam (E&E) system.

The need for an education redesign was recognized in 2001. Work began in 2002, and the new design was communicated to members in August 2003. The new E&E system is being implemented over 3 years, 2005-2007. It responds to employer and member research indicating the need to: 1) provide a more practice-relevant syllabus, 2) better prepare actuaries for the future and 3) reduce "travel time" to the ASA/FSA credential for qualified candidates.

Continue reading "Introducing the Fundamentals of Actuarial Practice"

Posted by Tom Troceen at 07:22 PM

Casualty Actuarial Society Seminar on Ratemaking to be Held March 13-14 in Salt Lake City

The future of the Terrorism Risk Insurance Act and applications in predictive modeling will be among topics addressed at the annual Seminar on Ratemaking of the Casualty Actuarial Society (CAS), March 13-14, 2006 at the Marriott Salt Lake City Downtown in Salt Lake City, Utah.

Members of the press are welcome to attend the seminar (fee waived) and are asked to register with Mike Boa, CAS director of communications and research, at 703-276-3100 in advance of the seminar.

The seminar presents a forum for the discussion of insurance issues, pricing concepts and methods. Sessions are available for insurance professionals with ratemaking knowledge levels that vary from limited to advanced, and the seminar provides an opportunity for actuaries to further their continuing education.

The opening general session will feature a discussion of ways to manage an insurer through a soft (buyer's) market from the perspective of both a CEO and a chief actuary. Speakers will include Robert V. James, Senior Managing Director, President, CEO and Chief Operating Officer of Balboa Insurance Company and Michael Fusco, Executive Vice President and Chief Actuary at CNA Insurance Companies.

Nearly 40 different concurrent sessions will be offered covering the following topics:

* Introductory track

* Workers compensation

* Data management and technology

* Commercial lines insurance

* Personal lines insurance

* Risk and capital management

* Regulatory issues

* Reinsurance

* Specialty topics

The seminar will conclude with a "town hall" general session on the current state of the Terrorism Risk Insurance Act (TRIA) and its future.

The fee for the seminar is $700 for active candidates, Affiliates, Associates and Fellows of the CAS, $800 for non-CAS members and $350 for government employees, if received on or before February 24. All fees increase by $50 after this date. For registration information, visit the online brochure.

The Casualty Actuarial Society is an organization dedicated to the advancement of the body of knowledge of actuarial science applied to property, casualty and similar risk exposures. The primary goal of the Casualty Actuarial Society is to provide education and research to help its members be the leading experts in the evaluation of hazard risk and the integration of hazard risk with strategic, financial and operational risk.

Contact: Taresa LaRock

Phone: (703) 276-3100

Posted by Tom Troceen at 07:17 PM