« Aon Consulting Appoints a Chairman and Vice Chairman of U.S. Operations | Main | New reports affirm stable outlook on HK insurance sector »

February 23, 2006

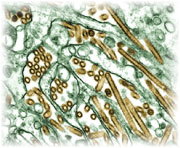

Society of Actuaries embarks on unique research around pandemic influenza and the U.S. insurance industry’s preparedness

The Society of Actuaries (SOA) is beginning research on the possible implications of an avian flu pandemic on the insurance industry. With this study, the SOA expects to provide insight into the potential impact a pandemic could have on life and health insurers.

The Society of Actuaries (SOA) is beginning research on the possible implications of an avian flu pandemic on the insurance industry. With this study, the SOA expects to provide insight into the potential impact a pandemic could have on life and health insurers.

Jim Toole, fellow of the Society of Actuaries and managing director of MBA Actuaries, will undertake the effort. Toole brings his actuarial expertise in risk measurement and management to address the readiness of the insurance industry to face a pandemic.

“Advance planning is critical. An insurer needs to do more than just study how a pandemic might affect the amount and timing of claim dollars it pays to its policyholders. It will also need to consider how it will function at unprecedented claim volumes, when as many as 50 percent of its employees are ill or absent providing care for family members. The research will assess the total risk to an insurer, discussing vital considerations for before, during and after an event that might mitigate or exacerbate the consequences of a severe or moderate pandemic,” said Toole.

Tom Edwalds, fellow of the Society of Actuaries and chairperson of the SOA's oversight committee for this research, believes "the possible effects of pandemic influenza are important to the U.S. life and health insurance industry because it may increase the severity and frequency of the payment of death benefits and medical treatment compared to anticipated, potentially affecting an insurer's or reinsurer's solvency. For actuaries and other risk management professionals examining the risk of pandemic influenza, understanding the potential impact of the event on U.S. mortality and morbidity is critical. We believe this research will be a useful resource for them."

Results from this research initiative will be made available during the SOA's Spring Health Meeting in June in Hollywood, Fla.

Background

Effect of Pandemic Influenza on North American Mortality and Morbidity

Pandemic Influenza naturally occurs every 30-40 years. The last three events were in 1918, 1957, and 1968.

Health experts believe that the current avian influenza (H5N1) now circulating in East Asia is the greatest risk for creating a new pandemic. The World Health Organization has confirmed 57 deaths (as of 8/5/05) in Vietnam, Cambodia, Thailand, and Indonesia. Over ten countries have experienced outbreaks in poultry flocks, which indicates that H5N1 is endemic throughout the region.

The possible effects of pandemic influenza are important to the North American life and health insurance industry because it may increase the severity and frequency of the payment of death benefits and medical treatment compared to anticipated potentially affecting an insurer’s/reinsurer’s solvency. For actuaries and other risk management professionals examining the risk of pandemic influenza, understanding the potential impact of the event on North American mortality and morbidity is critical.

Pandemic influenza also has significant economic consequences for the North American economy. It is important that the actuary understand the potential economic consequences and their implications to an insurance company.

II. PURPOSE

One purpose of this project is to create reference material to educate actuaries and other risk management professionals on North American mortality and morbidity risks of pandemic influenza. In addition, the information provided is to be a resource for the development of mortality and morbidity assumptions regarding the long-tail risk of pandemic influenza for scenario testing.

A second purpose of the research is to provide informaton on the economic consequences of a pandemic influenza event in North America and to analyze the implications for the life insurance industry.

III. RESEARCH OBJECTIVE

The first objective for this project is to perform analysis relating to the effect of pandemic influenza on mortality and morbidity by identifying, reviewing and compiling data and findings from existing literature/studies and/or original research.

The second objective for this project is to examine the economic effect of pandemic influenza in North America. Using the results developed on the effect of pandemic influenza on mortality and morbidity, the researcher will examine the economic costs to society borne by a possible pandemic influenza outbreak. Finally, the researcher will analyze the implications that the economic costs will have on the life insurance industry.

Inputs to be considered in meeting the research objective may include but are not limited to: a literature search of historical information, a survey utilizing the Delphi method of actuaries and/or risk managers, and a search for existing models of pandemic influenza.

Research results will be summarized into a report suitable for publication that consists of but is not limited to the following:

· Ranges of morbidity and mortality rates assuming that pandemic influenza has occurred;

· Reasons for the estimated ranges; and

· Parameter sets which will allow users to run their own Monte-Carlo scenarios.

· Economic cost estimates;

· Methodology and reasons for arriving at that cost; and

· Implictions of the economic costs on the life insurance industry.

For this topic, the Committee on Life Insurance Research envisions a short-term project with an expected timeframe for completion of three to six months. For final evaluation of proposals, it is important that researchers comment on how this timeframe can be reasonably ensured.

IV. PROPOSAL

To facilitate the evaluation of proposals, the following information should be submitted:

1. Resumes of the researcher(s), including any graduate student(s) expected to participate, indicating how their background, education, and experience bear on their qualifications to undertake the research. If more than one researcher is involved, a single individual should be designated as the lead researcher and primary contact. The person submitting the proposal must be authorized to speak on behalf of all the researchers as well as for the firm or institution on whose behalf the proposal is submitted.

2. An outline of the approach to be used, emphasizing issues that require special consideration. Details should be given regarding the techniques to be used, collateral material to be consulted, and possible limitations of the analysis.

3. Cost estimates for the research, including computer time, salaries, report preparation, research costs, etc. Such estimates can be in the form of hourly rates, but in such cases, time estimates should also be included

4. Any guarantees as to total cost should be given and will be considered in the evaluation of the proposal. While cost will be a factor in the evaluation of the proposal, it will not necessarily be the decisive factor.

5. A schedule for completion of the research, identifying key dates or time frames for research completion and report submissions.

6. Ideas regarding the form and distribution of the final report, both for immediate release and for permanent reference (e.g., submission to North American Actuarial Journal or other refereed publication, TSA Reports, SoA Monograph Series, CD ROM).

7. Other related factors that give evidence of a proposer’s capabilities to perform in a superior fashion should be detailed.

V. SELECTION PROCESS

The Committee on Life Insurance Research (CLIR) is responsible for the selection of the proposal to be funded. Input from other knowledgeable individuals also may be sought, but CLIR will make the final decision. The SOA’s Research Actuary will provide staff actuarial support. A Project Oversight Group (POG) will be appointed by CLIR to oversee the project upon selection of the proposal.

VI. QUESTIONS

Any questions regarding this RFP should be directed by fax, or e-mail to: Ronora Stryker, SOA Research Actuary (Fax: 847-273-8514; e-mail: rstryker@soa.org).

VII. NOTIFICATION OF INTENTION TO SUBMIT PROPOSAL

If you intend to submit a proposal, please send written notification by November 22, 2005 to:

Jan Schuh, SOA Research Administrator

e-mail (jschuh@soa.org)

FAX (847-273-8556)

mail to

Society of Actuaries

475 N. Martingale Road, Suite 600

Schaumburg, IL 60173-2226.

VIII. SUBMISSION OF PROPOSAL

Please e-mail a copy of the proposal to:

Jan Schuh at jschuh@soa.org

Proposals must be received no later than November 30, 2005. It is anticipated that all researchers who have submitted proposals will be informed of the status of their proposal no later than January 15, 2006.

Note: Proposals are considered confidential and proprietary.

IX. CONDITIONS

The Society of Actuaries reserves the right to not award a contract for this research. Reasons for not awarding a contract could include, but are not limited to, a lack of acceptable proposals or a finding that insufficient funds are available to proceed. The Society of Actuaries also reserves the right to redirect the project as is deemed advisable.

The Society of Actuaries intends to copyright and publish the results of this research. The research will be considered work-for-hire and all rights thereto belong to the Society of Actuaries. However, appropriate credit will be given to the researcher(s).

Posted by Tom Troceen